Get the free payoff request letter form

Show details

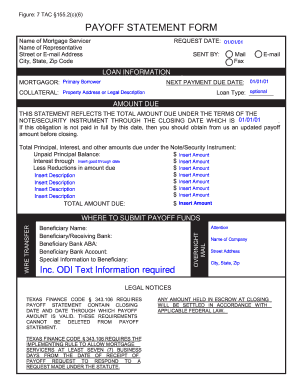

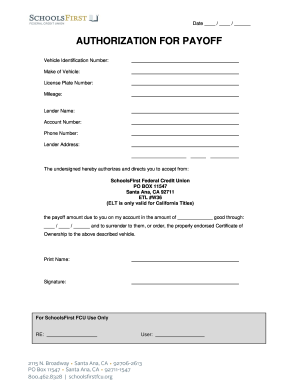

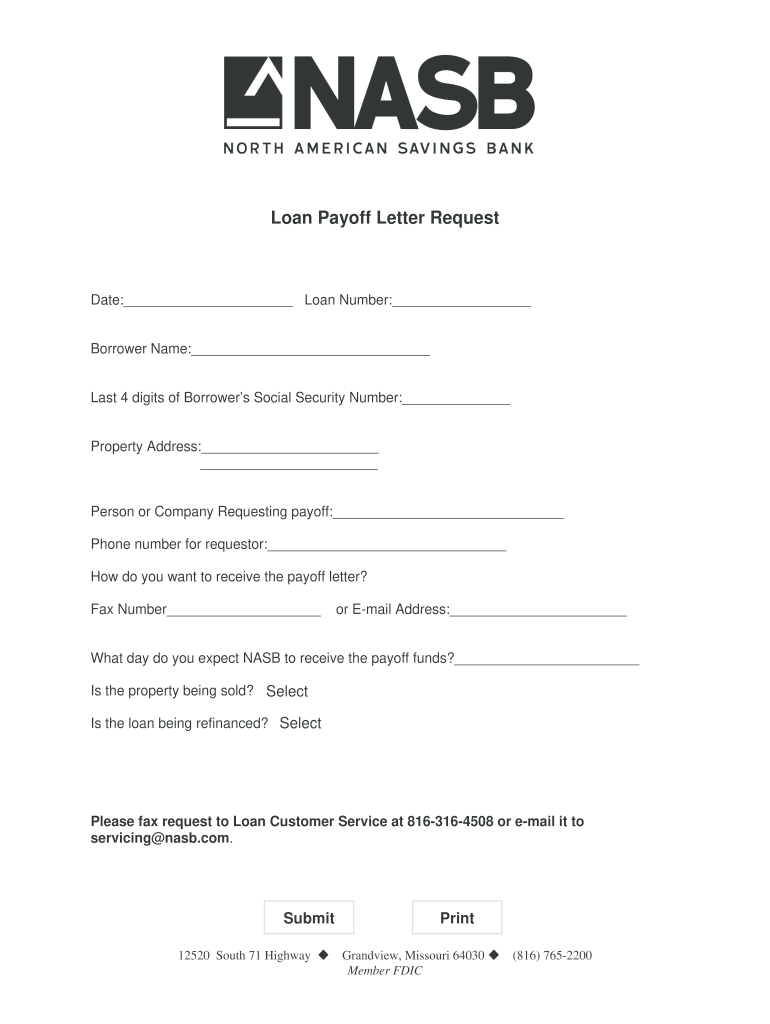

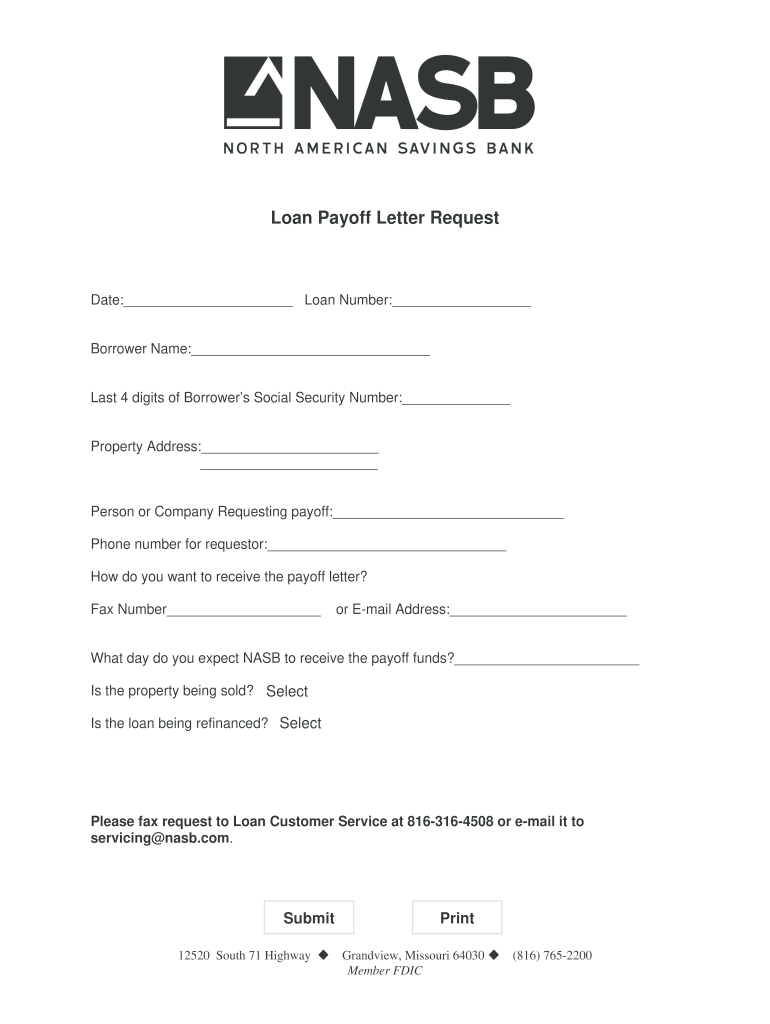

Loan Payoff Letter Request Date Loan Number Borrower Name Last 4 digits of Borrower s Social Security Number Property Address Person or Company Requesting payoff Phone number for requestor How do you want to receive the payoff letter Fax Number or E-mail Address What day do you expect NASB to receive the payoff funds Is the property being sold Select No Yes or Is the loan being refinanced Select No Please fax request to Loan Customer Service at 816-316-4508 or e-mail it to servicing nasb.com....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your payoff request letter form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payoff request letter form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payoff request letter online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit request for loan payoff letter form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out payoff request letter form

How to fill out request payoff:

01

Gather all the necessary information, including the account details, loan number, and any outstanding balance.

02

Contact the financial institution or lender who holds the loan and request a payoff quote or payoff statement.

03

Fill out any required forms or provide any additional documentation that may be requested by the lender.

04

Review the payoff quote or statement carefully to ensure that all the information is correct, including the total amount due and any applicable fees or interest charges.

05

Determine the preferred method of payment and make arrangements to submit the payment accordingly.

06

Keep a copy of the request payoff form, quote or statement, and proof of payment for your records.

Who needs request payoff:

01

Individuals who have an outstanding loan with a financial institution or lender.

02

Borrowers who are planning to pay off their loan balance in full and want to obtain an accurate payoff amount.

03

Any individual or entity involved in financial planning or budgeting who wants to have an accurate understanding of their outstanding debts.

Fill request payoff : Try Risk Free

People Also Ask about payoff request letter

How do I request a payoff request?

How long does it take to get a payoff request?

Can I request a payoff quote?

What is a payoff request form?

How do I request a loan payoff amount?

What is a payoff verification form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is request payoff?

Request payoff is a request sent by a borrower to their lender asking for a statement of the amount of money they owe on their loan. The statement will include the total amount due, as well as any accrued interest or other charges that may be associated with the loan. The request is normally used to determine the amount of money needed to pay off the loan in full, and can be used to help a borrower make a decision about whether to refinance or pay off the loan.

Who is required to file request payoff?

The borrower is typically responsible for filing a request for payoff. The request should include the loan number, the name of the borrower, the date of the request, and the address of the borrower.

What is the purpose of request payoff?

Request payoff is an important part of the loan process that allows borrowers to get a full payment amount for their loan and pay off the loan in full. This is done when a borrower is ready to close out their loan and make their final payment. Requesting a payoff amount and paying off the loan in full will help borrowers avoid late fees and other penalties associated with delinquent payments.

What information must be reported on request payoff?

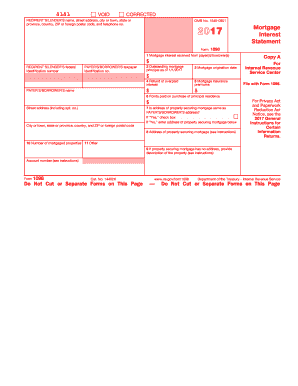

The information that must be reported on a request payoff includes the account number, the outstanding balance, and the repayment terms. It may also include any additional fees or charges that may be due at the time of payoff.

When is the deadline to file request payoff in 2023?

The deadline to file a request payoff in 2023 is December 31st, 2023.

What is the penalty for the late filing of request payoff?

The penalty for late filing of a request for payoff can vary depending on the specific circumstances and regulations set by the relevant authorities or organizations involved. In general, it may result in consequences such as late fees, accrued interest, negative impacts on credit scores, or potential legal actions. It is recommended to refer to the specific terms and conditions provided by the organization or institution in question to understand the penalties associated with late filing of a request for payoff.

How to fill out request payoff?

To fill out a request payoff, you will typically need to follow these steps:

1. Begin by accessing the necessary forms or documents provided by your lender or financial institution.

2. Fill in your personal information, including your name, address, and contact details. Make sure to double-check the accuracy of the information.

3. Provide your loan or account number. This is usually found on your billing statement or account documents.

4. Indicate the purpose of your request, which is to obtain the payoff amount. You might need to select the specific reason for the request, such as a refinancing, sale of property, or full loan repayment.

5. Enter the effective date or requested date for the payoff information. This date will be used to calculate the outstanding balance on your loan or account.

6. Add any additional instructions or details in the appropriate section of the form. This may include any special requirements or preferences you have regarding the payoff process.

7. Sign and date the form where indicated. Some forms may require your signature in multiple places, so carefully review each section.

8. Submit the completed form to your lender or financial institution using the preferred method outlined in the instructions. This can often be done through mail, email, or online submission.

9. If necessary, keep a copy of the completed form for your records. Additionally, you may want to make note of the submission date and any correspondence with your lender regarding the request.

Note: The specific steps and requirements for filling out a request payoff can vary depending on the lender or financial institution you are dealing with. It is always best to refer to the provided instructions or contact the institution directly for guidance if needed.

How do I fill out the payoff request letter form on my smartphone?

Use the pdfFiller mobile app to complete and sign request for loan payoff letter form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit 10 day payoff letter template on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 10 day payoff letter sample from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit 10 day payoff letter on an Android device?

With the pdfFiller Android app, you can edit, sign, and share loan payoff letter request form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your payoff request letter form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10 Day Payoff Letter Template is not the form you're looking for?Search for another form here.

Keywords relevant to sample mortgage payoff request letter form

Related to mortgage payoff request letter

If you believe that this page should be taken down, please follow our DMCA take down process

here

.