NASB Loan Payoff Letter Request free printable template

Show details

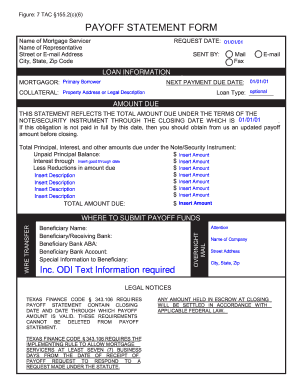

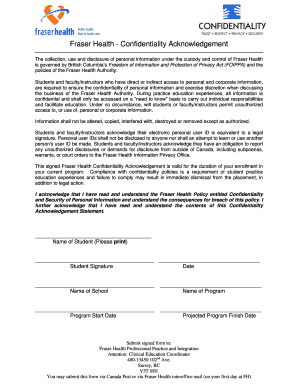

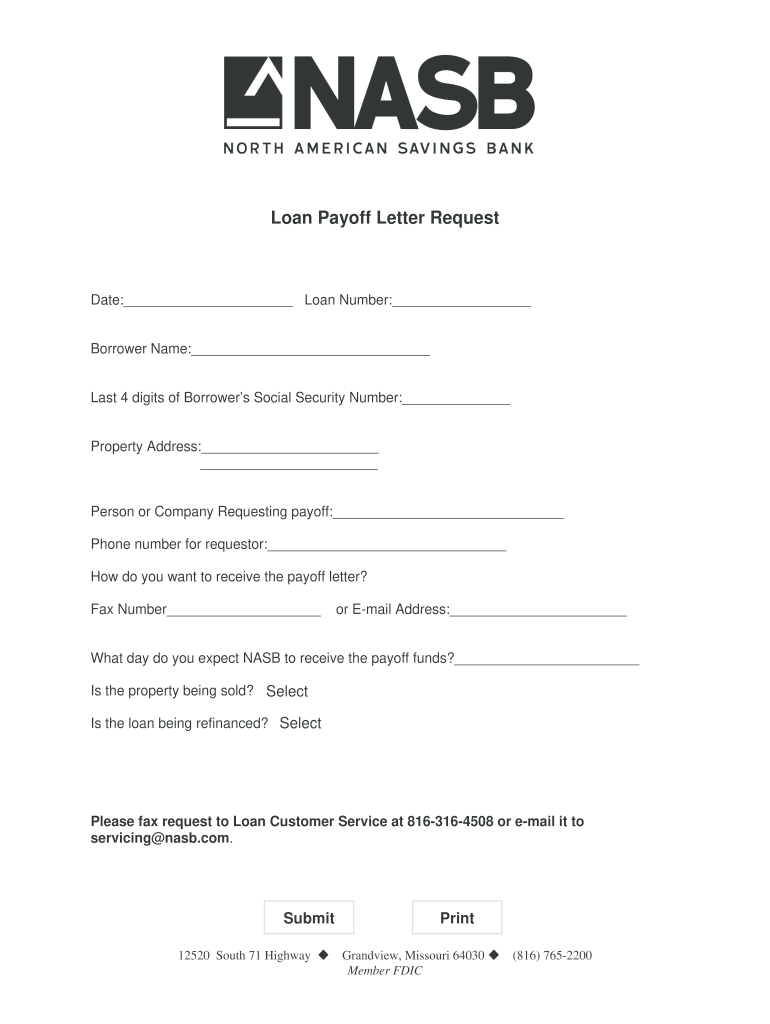

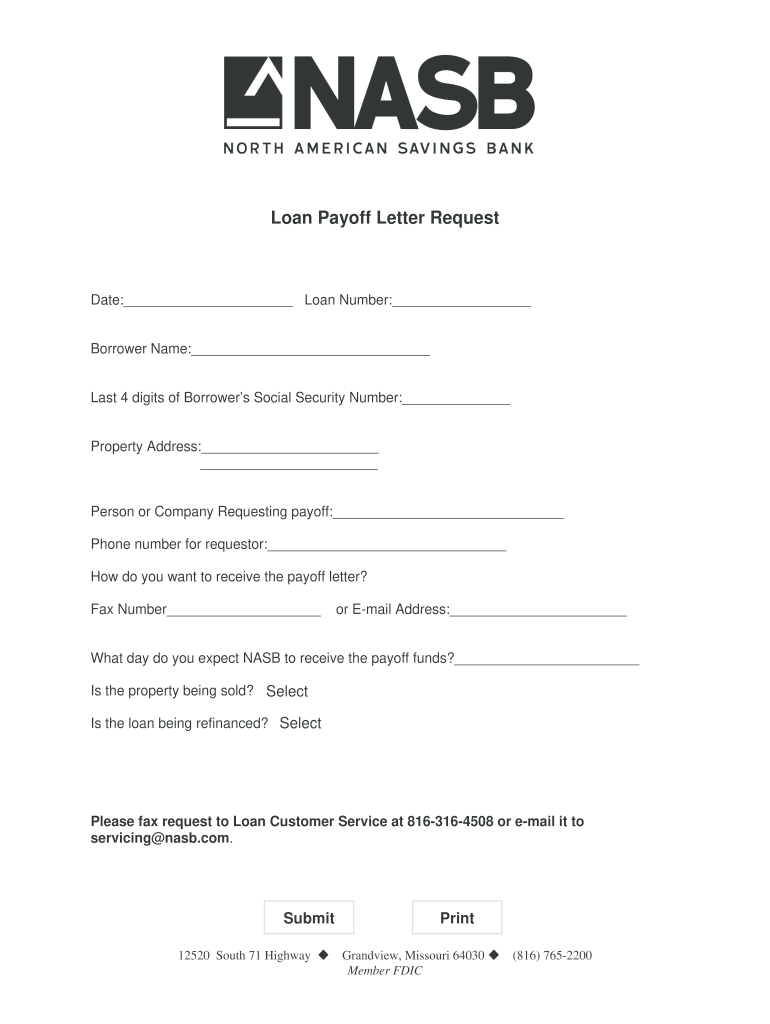

Loan Payoff Letter Request Date Loan Number Borrower Name Last 4 digits of Borrower s Social Security Number Property Address Person or Company Requesting payoff Phone number for requestor How do you want to receive the payoff letter Fax Number or E-mail Address What day do you expect NASB to receive the payoff funds Is the property being sold Select No Yes or Is the loan being refinanced Select No Please fax request to Loan Customer Service at 816-316-4508 or e-mail it to servicing nasb.com....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 10 day payoff letter template form

Edit your sample loan payoff request letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan payoff letter request template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan payoff request form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payoff request letter example form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10 day payoff letter form

How to fill out NASB Loan Payoff Letter Request

01

Obtain the NASB Loan Payoff Letter Request form from the NASB website or customer service.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the loan account number for which you are requesting the payoff amount.

04

Indicate the specific date you want the payoff amount calculated for.

05

Sign and date the request form.

06

Submit the completed form via email, fax, or mail to the appropriate NASB department.

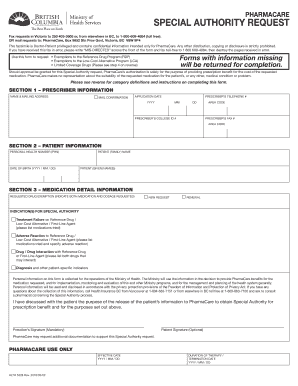

Who needs NASB Loan Payoff Letter Request?

01

Any borrower who wishes to obtain the total payoff amount for their NASB loan.

02

Individuals who are planning to refinance or pay off their existing NASB loan.

03

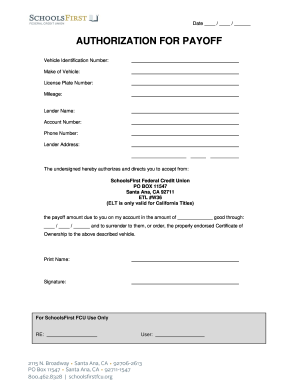

Real estate agents or closing agents involved in a property transaction that requires a loan payoff.

Fill

loan payoff request form template

: Try Risk Free

People Also Ask about vehicle payoff letter template

How do I request a payoff request?

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How long does it take to get a payoff request?

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

Can I request a payoff quote?

The payoff amount may also include other fees you have incurred and have not yet paid. If you are paying off your loan early, you may have to pay a pre-payment penalty. If you are considering paying off your mortgage, you can request a payoff amount from your lender or servicer.

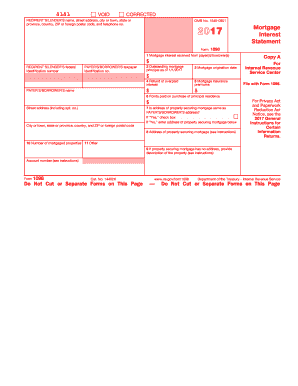

What is a payoff request form?

You request a payoff statement from your lender when you want to know exactly how much it costs to pay off your house. You need this information before you sell your home, refinance the mortgage or you otherwise decide to get rid of the debt.

How do I request a loan payoff amount?

How do I find that amount? Your loan holder/servicer can provide your payoff amount, which will include principal and interest, as well as other fees and costs on your account (if applicable). Contact your servicer for your payoff amount.

What is a payoff verification form?

A payoff statement is a document you must request from your current loan servicer which lets us know the funds required to close out your loan(s) at a future date, which includes all interest accrued between today and that future date. It takes your daily interest into account, unlike your regular monthly statement.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the request for loan payoff letter form on my smartphone?

Use the pdfFiller mobile app to complete and sign payoff letter template on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit payoff request letter sample on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share loan payoff letter form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit auto loan payoff letter sample on an Android device?

With the pdfFiller Android app, you can edit, sign, and share loan payoff letter on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NASB Loan Payoff Letter Request?

The NASB Loan Payoff Letter Request is a formal document submitted by a borrower to request the total amount required to pay off their loan with the National Association of Securities Dealers (NASB). This document typically outlines the specifics of the loan and seeks a detailed breakdown of the remaining balance.

Who is required to file NASB Loan Payoff Letter Request?

The borrower, or individual who has taken out a loan with NASB, is required to file the NASB Loan Payoff Letter Request when they wish to obtain the payoff amount for their loan.

How to fill out NASB Loan Payoff Letter Request?

To fill out the NASB Loan Payoff Letter Request, the borrower needs to provide their loan account number, personal identification information, details of the loan such as the type and specific terms agreed upon, and any additional information requested by NASB to process the request.

What is the purpose of NASB Loan Payoff Letter Request?

The purpose of the NASB Loan Payoff Letter Request is to formally inquire about the remaining balance of a loan, including any interest or fees that may be applicable, allowing the borrower to accurately plan for full repayment of their loan.

What information must be reported on NASB Loan Payoff Letter Request?

The NASB Loan Payoff Letter Request must include information such as the borrower's name, contact details, loan account number, loan type, the desired payoff date, and any other pertinent details that NASB may require to identify the loan and process the request.

Fill out your NASB Loan Payoff Letter Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Payoff Letter Format is not the form you're looking for?Search for another form here.

Keywords relevant to loan payoff letter example

Related to 10 day payoff

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.